All Categories

Featured

Table of Contents

- – Harmony SoCal Insurance Services

- – What Is Long-Term Care Insurance and Why Do Se...

- – Key Components of Long-Term Care Insurance Po...

- – Common Triggers for Benefits

- – Why Focus on Staying at Home Longer?

- – How Much Does Long-Term Care Insurance Cost in...

- – Main Factors Affecting Premiums

- – Average Costs by Age and Coverage Level

- – Ways to Manage Costs Effectively

- – Types of Long-Term Care Insurance Plans Availa...

- – Traditional vs Hybrid Long-Term Care Insurance

- – Essential Riders for Home-Focused Coverage

- – Specialized Features for Unique Situations

- – Best Long-Term Care Insurance Companies and Pl...

- – Leading Companies and Their Strengths

- – Comparison of Key Features

- – How to Choose the Right Long-Term Care Insuran...

- – Step-by-Step Selection Process

- – Important Considerations to Avoid

- – Essential Questions for Advisors

- – Common Concerns About Long-Term Care Insurance...

- – Addressing Cost Concerns

- – Qualification and Health Issues

- – Unused Policy Value

- – Protect Your Independence with the Right Long-...

- – Understanding the Risks of Delaying

- – Real Client Transformations

- – Serving Communities Across Southern California

- – We Can Help! Contact Us Today

- – Frequently Asked Questions About Long-Term Car...

- – What is long-term care insurance?

- – How much does it cost in Southern California?

- – Is it worth purchasing?

- – What services are covered?

- – When is the best time to buy?

- – Does Medicare cover long-term care?

- – What makes hybrid policies different?

- – How does underwriting work?

- – Options for those over 70?

- – Benefits of Partnership plans?

- – Harmony SoCal Insurance Services

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

Many seniors share a heartfelt goal: continuing to live in the comfort of their own homes as they age, surrounded by familiar surroundings and close to loved ones. The growing demand for reliable long-term care insurance reflects this genuine desire to maintain independence while receiving needed support.

Medicare provides excellent medical coverage but leaves out ongoing assistance with daily tasks. This is where well-chosen long-term care insurance plays a key role, providing resources for in-home care, personal help, and services that support aging in place.

In Southern California, where care costs tend to surpass national averages, forward-thinking planning proves especially valuable. Approximately 70% of people over 65 will require some form of long-term care, according to the U.S. Department of Health and Human Services.

Many people begin searching for "long-term care insurance southern california" or "best long-term care insurance for staying at home" after meaningful family discussions. Common questions include "what is long-term care insurance" and "how much does long-term care insurance cost".

The emotional desire to avoid burdening family combines with logical concerns about protecting savings. Coverage opens access to professional caregivers, home modifications, and coordination without draining resources.

Contemporary options like hybrid long-term care insurance and Partnership-qualified policies bring added flexibility and security.

What Is Long-Term Care Insurance and Why Do Seniors Need It to Stay at Home?

Long-term care insurance provides financial support when health changes make everyday tasks difficult to manage alone. It covers home health care, personal assistance, and services promoting aging in place.

This coverage focuses on custodial care—help with activities of daily living such as bathing, dressing, eating, or mobility—rather than medical treatment. Benefits generally begin when someone cannot perform two or more of these activities or experiences cognitive impairment.

Most seniors strongly prefer receiving care at home. Plans with robust home care benefits match ideally with this preference.

Key Components of Long-Term Care Insurance Policies

The daily benefit amount determines reimbursement levels. Benefit periods vary from a few years to lifetime.

The elimination period works like a deductible, with waiting times before payments start. Inflation protection riders increase benefits over time.

Common Triggers for Benefits

Chronic illness or functional limitations qualify claimants. Cognitive impairment from dementia also activates coverage.

Why Focus on Staying at Home Longer?

In-home care supports personalized routines in familiar settings. Services include caregivers, meal delivery, and transportation.

Coverage frequently extends to home safety modifications that prevent falls and extend independence. This approach preserves dignity and comfort.

Contact us for a complimentary consultation to explore matching options.

How Much Does Long-Term Care Insurance Cost in Southern California?

Long-term care insurance costs vary based on age, health, coverage level, and location. Sooner applications generally secure lower premiums.

In Southern California, regional care expenses influence rates. Healthy individuals in their 50s frequently pay $2,000–$4,000 annually for solid protection.

Couples applying jointly commonly receive meaningful discounts. Riders like inflation protection enhance value while raising current costs.

Main Factors Affecting Premiums

Age at purchase drives pricing significantly. Health status determines available rates.

Benefit amounts and policy length impact expenses. Location adjusts for local in-home care costs.

Average Costs by Age and Coverage Level

Mid-50s applicants encounter $1,800–$3,000 ranges. Those in their 60s often pay $2,500–$4,500.

Hybrid long-term care insurance may involve different payment structures. Partnership plans add asset safeguards.

Ways to Manage Costs Effectively

Longer elimination periods reduce premiums. Shared care helps couples efficiently.

Tax-qualified status offers deductibility advantages. Professional guidance identifies optimal combinations.

Learn more about senior protection plans.

Types of Long-Term Care Insurance Plans Available in California

California features traditional reimbursement policies and innovative hybrid long-term care insurance. Eye Insurance For Seniors Stanton. Each serves different priorities

Traditional plans focus on care expenses with regular premiums. Hybrid designs integrate life insurance features.

The California Partnership for Long-Term Care provides asset protection for qualified policies.

Traditional vs Hybrid Long-Term Care Insurance

Traditional offers dedicated care pools. Hybrid long-term care insurance guarantees value through death benefits or returns.

Essential Riders for Home-Focused Coverage

Inflation protection maintains purchasing power. Home enhancement riders boost in-home payouts.

Specialized Features for Unique Situations

Some include telehealth coordination or respite care. These add meaningful support.

Explore related hospice coverage.

Best Long-Term Care Insurance Companies and Plans for Aging in Place

Top carriers receive strong ratings for reliability and home care focus. Mutual of Omaha, Nationwide, New York Life, and MassMutual lead consistently.

Leading Companies and Their Strengths

Mutual of Omaha prioritizes customizable home care benefits. Nationwide excels in hybrid options.

New York Life offers robust inflation protection. MassMutual provides extensive riders.

Comparison of Key Features

| Company | Home Care Emphasis | Inflation Options | Financial Rating |

|---|---|---|---|

| Mutual of Omaha | High | Compound | A+ |

| Nationwide | Strong | Flexible | A+ |

| New York Life | Comprehensive | Robust | A++ |

| MassMutual | Extensive | Compound | A++ |

We vs Typical Competitor.

| Feature | Our Team | Typical Competitor |

|---|---|---|

| Plan Matching | Multi-carrier | Single company |

| Local Expertise | Southern CA focus | National center |

| Support | Annual reviews | Limited |

View our carrier network.

How to Choose the Right Long-Term Care Insurance Policy for Staying Home

Selection involves assessing health, finances, and preferences for aging in place.

Step-by-Step Selection Process

Evaluate current wellness and family history. Determine target in-home care benefits.

Compare quotes and riders carefully.

Important Considerations to Avoid

Insufficient inflation protection. Limited home care provisions.

Essential Questions for Advisors

How do plans maximize aging in place? What elimination period fits best?

Discover more through our process.

Common Concerns About Long-Term Care Insurance and How to Address Them

Buyers frequently worry about affordability and qualifications. Clear answers help.

Addressing Cost Concerns

Early purchase manages rates. Tax advantages offset portions.

Qualification and Health Issues

Current wellness secures best terms (Eye Insurance For Seniors Stanton). Some accommodate moderate conditions

Unused Policy Value

Hybrid long-term care insurance ensures benefits. Partnership adds safeguards.

Explore impaired risk options.

Protect Your Independence with the Right Long-Term Care Plan Today

Preparing now safeguards future choices and comfort.

Understanding the Risks of Delaying

Health changes reduce options. Eye Insurance For Seniors Stanton. Costs increase steadily

Real Client Transformations

"Professional help at home made recovery comfortable." – Margaret T., San Bernardino.

"Unused benefits pass to children." – Robert and Susan L., Ventura.

"Seamless assistance transition." – David M., Inland Empire.

Serving Communities Across Southern California

Support covers Orange County, Los Angeles, Inland Empire, Riverside, San Bernardino, San Fernando, Ventura, and San Diego.

We Can Help! Contact Us Today

The drive to maintain independence inspires planning, while asset protection and tax benefits provide logical foundation.

Harmony SoCal Insurance Services, 2135 N Pami Cir, Orange, CA 92867, (714) 922-0043.

With expert experience, we deliver peace of mind and financial safeguards.

Harmony SoCal Insurance Services, 2135 N Pami Cir, Orange, CA 92867, (714) 922-0043.

Contact us today to explore plans supporting your vision. Visit reach out.

Additional resources: family protection, business coverage, advantage plans.

Frequently Asked Questions About Long-Term Care Insurance

What is long-term care insurance?

Long-term care insurance pays for assistance for daily tasks when health changes. It supports in-home care and custodial care. See essential info.

How much does it cost in Southern California?

Rates differ by age and benefits, frequently $2,000–$4,000 annually. Couples qualify for discounts. Explore who we are.

Is it worth purchasing?

Definitely for asset protection and independence. Hybrid options guarantee value. Review success stories.

What services are covered?

Home health care, respite, and coordination. Riders add home modifications. Check perks.

When is the best time to buy?

Mid-50s to early 60s for optimal rates. Consider parenting advice.

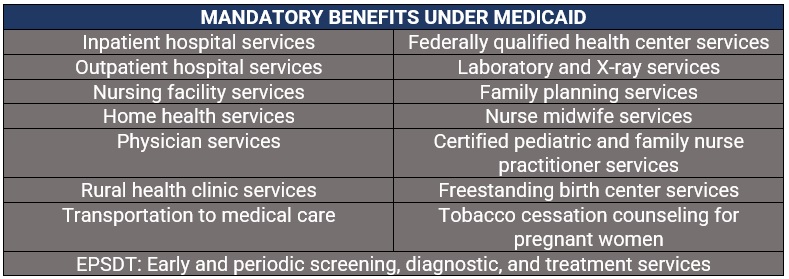

Does Medicare cover long-term care?

No ongoing custodial care. Long-term care insurance fills gaps. Learn enrollment help.

What makes hybrid policies different?

Combine life insurance for guaranteed value. Compare additional protection.

How does underwriting work?

Assesses medical history. Wellness secures rates. See process.

Options for those over 70?

Still open but limited. Health critical. Review tips.

Benefits of Partnership plans?

Asset protection with Medi-Cal. Explore disability options.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

Health Insurance Seniors Stanton, CA

Medicare Part D Plans Near Me Stanton, CA

Senior Benefits Insurance Services Stanton, CA

Senior Insurance Solutions Stanton, CA

Eye Insurance For Seniors Stanton, CA

Best Supplemental Insurance For Seniors Stanton, CA

Insurance Companies For Seniors Stanton, CA

Medical Insurance For Senior Stanton, CA

Eye Insurance For Seniors Stanton, CA

Eyeglass Insurance For Seniors Stanton, CA

Senior Benefits Insurance Services Stanton, CA

Vision Dental Insurance For Seniors Stanton, CA

Medical Insurance For Senior Stanton, CA

Best Senior Medical Insurance Stanton, CA

Best Senior Medical Insurance Stanton, CA

Best Supplemental Insurance For Seniors Stanton, CA

Best Eye Insurance For Seniors Stanton, CA

Medicare Supplement Insurance Near Me Stanton, CA

Affordable Home Insurance For Seniors Stanton, CA

Medicare Part D Plans Near Me Stanton, CA

Medicare Supplement Insurance Near Me Stanton, CA

Insurance Senior Citizens Stanton, CA

Insurance Companies For Seniors Stanton, CA

Medicare Part D Plans Near Me Stanton, CA

Health Insurance Seniors Stanton, CA

Eyeglass Insurance For Seniors Stanton, CA

Best Eye Insurance For Seniors Stanton, CA

Medicare Health Insurance For Seniors Stanton, CA

Senior Insurance Companies Stanton, CA

Near You Seo Management Stanton, CA

Companies Near Me Seo Services Pricing Stanton, CA

Harmony SoCal Insurance Services

Dental Insurance For Seniors Over 65 Stanton, CA

Vision Dental Insurance For Seniors Stanton, CA

Table of Contents

- – Harmony SoCal Insurance Services

- – What Is Long-Term Care Insurance and Why Do Se...

- – Key Components of Long-Term Care Insurance Po...

- – Common Triggers for Benefits

- – Why Focus on Staying at Home Longer?

- – How Much Does Long-Term Care Insurance Cost in...

- – Main Factors Affecting Premiums

- – Average Costs by Age and Coverage Level

- – Ways to Manage Costs Effectively

- – Types of Long-Term Care Insurance Plans Availa...

- – Traditional vs Hybrid Long-Term Care Insurance

- – Essential Riders for Home-Focused Coverage

- – Specialized Features for Unique Situations

- – Best Long-Term Care Insurance Companies and Pl...

- – Leading Companies and Their Strengths

- – Comparison of Key Features

- – How to Choose the Right Long-Term Care Insuran...

- – Step-by-Step Selection Process

- – Important Considerations to Avoid

- – Essential Questions for Advisors

- – Common Concerns About Long-Term Care Insurance...

- – Addressing Cost Concerns

- – Qualification and Health Issues

- – Unused Policy Value

- – Protect Your Independence with the Right Long-...

- – Understanding the Risks of Delaying

- – Real Client Transformations

- – Serving Communities Across Southern California

- – We Can Help! Contact Us Today

- – Frequently Asked Questions About Long-Term Car...

- – What is long-term care insurance?

- – How much does it cost in Southern California?

- – Is it worth purchasing?

- – What services are covered?

- – When is the best time to buy?

- – Does Medicare cover long-term care?

- – What makes hybrid policies different?

- – How does underwriting work?

- – Options for those over 70?

- – Benefits of Partnership plans?

- – Harmony SoCal Insurance Services

Latest Posts

Senior Pictures Photography Near Me Villa Park

Villa Park Affordable Wedding Photographer Near Me

Photographer For Weddings Near Me Costa Mesa

More

Latest Posts

Senior Pictures Photography Near Me Villa Park

Villa Park Affordable Wedding Photographer Near Me

Photographer For Weddings Near Me Costa Mesa